In the construction industry it’s very common for workers to operate as subcontractors, and it’s important to know your insurance requirements.

In this guide we’ll be looking at a range of common questions relating to subcontractor insurance requirements within the Australian building industry:

- Do I need insurance as a subcontractor?

- What insurance do you need as a subcontractor?

- Do subcontractor insurance requirements vary by state?

- Does it matter if I’m a sole trader or company?

- How much does subcontractor’s insurance cost?

- How much public liability do subcontractors require?

- Are subcontractors covered by my insurance?

If you’d rather talk with one of our specialists, please call us on 1800 808 800. We’ve helped thousands of subcontractors with their insurance requirements and would love to help you too.

If you’re ready to get some quotes to meet your subcontractor insurance requirements, hit the orange button below.

Continue scrolling to view the rest of our subcontractors insurance guide.

Do I need insurance as a subcontractor?

As a subcontractor you are running your own business, even if it’s just you as a sole trader.

This means you are largely responsible for your own actions, and if something goes wrong, you could be financially exposed.

For this reason there are a number of different insurance types required by subcontractors in Australia.

What insurance do you need as a subcontractor?

There are two main forms of insurance required by subcontractors. These are public liability insurance and income protection insurance.

Depending on your business activities you may also require professional indemnity insurance, but this is less common for most typical building trades.

Public Liability Insurance

The most commonly required form of subcontractor insurance is public liability.

Public liability insurance will respond in the event that you cause property damage or personal injury to a third party. A third party could be your client or a member of the general public.

Minor claims for public liability generally relate to property damage. For example you might be working in a roof and put your foot through the ceiling. As a subbie you’d be responsible for the cost of repairing and repainting the ceiling.

Larger claims typically relate to personal injury, and climb into the hundreds of thousands (or even millions) if you cause serious injury or death to another person as a result of your negligence.

It’s important to remember that you won’t always be covered by the main contractor’s insurance. If you are the one found to have been negligent, you are the one who will be held financially responsible.

For this reason, many building companies and contractors will have strict requirements in place that all subcontractors hold their own suitable public liability cover.

Even if the company engaging your services does not require that you hold public liability insurance, it is still incredibly important for your own protection.

Personal Accident Insurance

As a subcontractor you are not covered by sick leave, and in many cases worker’s compensation won’t protect a subbie either.

For this reason, personal accident insurance is not only important, but also mandatory for subcontractors on many worksites.

Personal accident insurance will cover a large percentage of your income for a period of time whilst you are unable to work due to injury or illness. As you won’t be receiving any sick leave, this is vitally important.

It is the same as income protection insurance?

Yes and no… Personal accident and income protection are very similar, but there are some important differences.

As insurance brokers we only deal with personal accident insurance, but we can refer you to a financial planner who can help with income protection insurance.

To further complicate matters you might have also heard terms like “injury and illness insurance” or “personal injury insurance“. These typically are the same as personal accident insurance, but are just different names used by different people.

Other insurance types

For a typical trade business there are no other insurance types that are a mandatory requirement for subcontractors, but there are certainly others worth considering.

Tool insurance is a common one, especially if you’re providing your own tools and equipment like most subbies do.

If your business is a little larger and operates from its own premises you’ll need more of a business package, but you

Do subcontractor insurance requirements vary by state?

There is really no difference in the subcontractor insurance requirements from one state to another.

For public liability there is certainly no difference. Whichever state you operate in, you will need to have your own public liability insurance in place.

There is one slight difference on the income protection side in NSW. It’s not that the income protection is different, but if you operate as a company in NSW you can access workers compensation, even if you’re a one-person company.

This may mean that you can hold workers compensation instead of income protection and may still meet the requirements of the company you are subcontracting to.

But remember that workers compensation is very different to income protection. It will only cover you for incidents at work, so if you simply fall ill or suffer an injury on the weekend, there is no cover.

A good income protection policy will cover you for both accident and illness regardless of whether it’s related to your work or not.

Note that the above only relates to a Pty Ltd company in NSW. If you’re a sole trader you cannot access workers compensation. We’ll cover this more in the next section.

Does it matter if I’m a sole trader or company?

For public liability insurance there will be no difference regardless of whether you operate as a sole trader or a company.

Either way, you will require public liability and there is no difference in the cover itself or the cost of the cover.

Income protection is no different. The insurer will class you as self-employed regardless of whether you operate as a sole trader or company, so the insurance will be the same either way.

As mentioned in the previous section, if you operate as a Pty Ltd company in NSW you may be able to use workers compensation instead of income protection, but it is a very different type of cover.

How much does subcontractor’s insurance cost?

The cost of subcontractors insurance can vary widely depending on a number of different factors.

For public liability insurance, the cost will vary depending on the size of the business in terms of revenue or staff numbers, as well as the business activities and whether or not those activities are undertaken in hazardous locations.

For example if you’re a one-person business undertaking standard residential carpentry, the public liability cost for the minimum $5 million cover will start from around $400 a year.

But if you’re a larger business with multiple staff undertaking higher-risk activities at locations such as airports or mine sites, the cost will be well into the thousands or even tens of thousands per year.

Income protection is different again. The cost of income protection for a subcontractor will depend on your age, occupation, smoking status and the trade you’re undertaking.

How much public liability do subcontractors require?

The amount of public liability insurance required by a subcontractor will largely depend on the companies they are contracting to.

Some companies may have no minimum requirement, meaning that you’d simply need the lowest amount of cover available, which in Australia is $5 million.

Other companies will require more, especially if they have you working in public places such as schools or shopping centres. In this case you’ll often find the requirement is $10m or $20m.

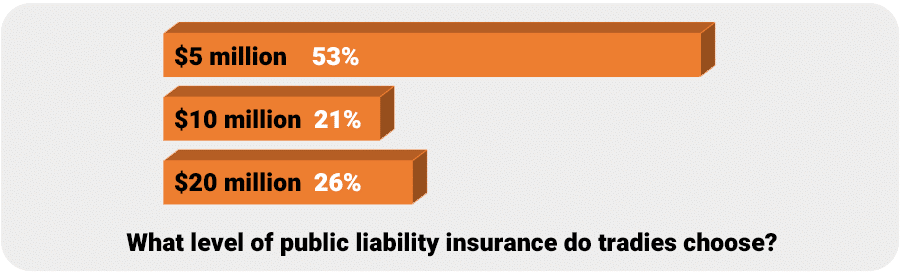

Whilst we cannot recommend a specific amount, we can show you what other trades in Australia choose:

Not all of these figures will come from subcontractors, but a large percentage of them will be.

This shows that most do go with the minimum $5 million cover, but a large percentage still choose the higher levels of $10m and $20m.

Are subcontractors covered by my insurance?

This is a very common question asked by those who are engaging subcontractors. They want to know if their public liability will cover their subbies.

The answer is almost always no. Whilst there are a few exceptions, the main contractor’s public liability insurance will generally not cover the subbie where it is found the subbie was negligent.

If you are subcontracting to a company and they claim you will be covered under their insurance, it’s best to get written confirmation of this rather than risk being uninsured in the event of a claim.

More information

At Trade Risk we help thousands of subcontractors with their insurance requirements.

If you’re after some advice or would like some quotes, please get in touch with our team and we’ll be happy to assist.

Click here to request a quote online, or call us on 1800 808 800.